A multi-vehicle accident (often defined as involving three or more cars) is chaotic. Unlike a two-car collision where fault is often binary, a pile-up involves a “chain reaction” where liability can be spread across four, five, or even ten different parties. When injuries are severe or vehicles are high-value, you enter the realm of high-limit claims—where insurance companies fight the hardest to avoid paying out.

1. Immediate Survival and Scene Management

Before a single legal document is signed, your actions at the scene dictate the success of your future claim.

-

Prioritize Safety: If the vehicles are movable, get them to the shoulder. In high-speed pile-ups, secondary collisions are common and often more deadly than the first.

-

The “Silent” Rule: Tensions will be high. Do not apologize or admit fault to anyone. Even a simple “I didn’t see you coming” can be used by an insurance adjuster to slash your compensation by 50% under comparative negligence laws.

-

Call 911: A police report is non-negotiable in multi-vehicle accidents. It serves as the official “blueprint” of the crash sequence.

2. Evidence Collection: The Documentation Powerhouse

In a high-limit claim, the person with the best data wins. Because there are multiple “stories” about how the crash happened, physical evidence is the only objective truth.

What to Capture:

-

Panoramic Photos: Take wide shots of the entire scene, including skid marks, debris patterns, and traffic signals.

-

Point of Impact: Photograph where each car hit the other. This helps accident reconstruction experts determine who hit whom first.

-

Witness Info: In a pile-up, the drivers are biased. Neutral witnesses (drivers who stopped but weren’t hit) are “litigation gold.”

-

Dashcam Footage: Check if your car or any surrounding vehicles have dashcams. This footage is the ultimate “silent witness.”

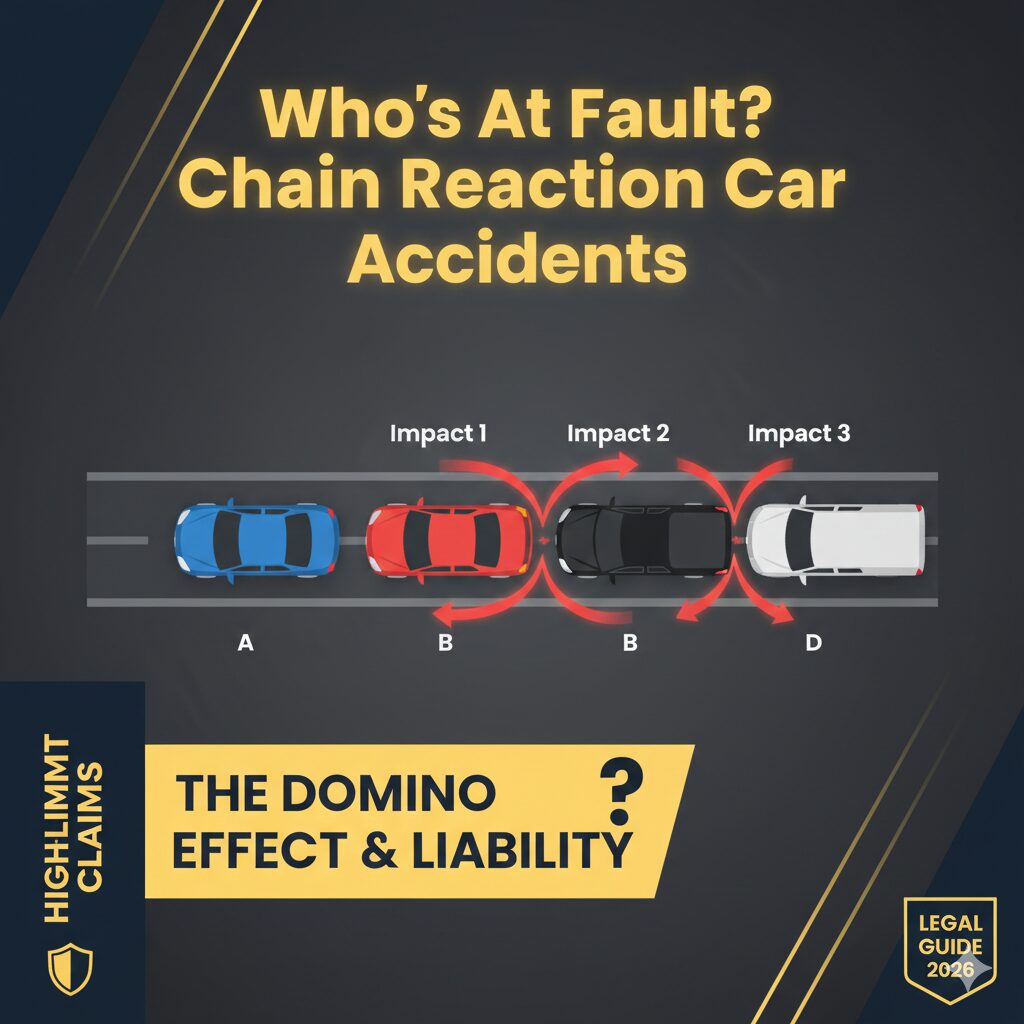

3. The Science of Fault: Who Actually Pays?

This is where multi-vehicle accidents get complicated. Most states follow a modified comparative fault system.

Example: If a judge determines you were 10% at fault because you were slightly speeding, but Driver A was 90% at fault for an illegal lane change, your $100,000 high-limit claim would be reduced to $90,000.

The Chain Reaction Logic:

In a classic rear-end chain, the “initiating” vehicle is typically liable for all subsequent hits. However, if the middle car was “tailgating” the lead car, they may share liability for the front-end damage. Identifying these nuances is key to tapping into higher insurance limits.

4. Navigating High-Limit Insurance Policies

Standard policies may not cover the massive damages of a pile-up. This is where you look for additional “buckets” of money:

-

Commercial Policies: If one of the vehicles was a delivery truck or a company car, they often have $1 million+ liability limits.

-

Umbrella Policies: High-net-worth drivers often carry umbrella insurance that kicks in after their primary auto limit is exhausted.

-

Underinsured Motorist (UIM): If the at-fault driver’s limits are too low to cover your $500,000 medical bill, your own UIM coverage can bridge the gap.

5. Why You Need a High-Stakes Attorney

Insurance companies employ “Special Investigation Units” for high-limit claims. Their goal is to find one reason to deny your claim. An experienced attorney does the following:

-

Hires Accident Reconstructionists: Scientists who use physics to prove the crash sequence.

-

Handles Multiple Adjusters: You won’t have to talk to five different insurance companies; your lawyer does it for you.

-

Calculates Future Damages: High-limit claims aren’t just about today’s bills. They include lost earning capacity, future surgeries, and long-term “loss of enjoyment of life.”

Conclusion: Don’t Settle for Less Than Your Worth

A multi-vehicle accident can feel like your life has been put on hold. But with the right documentation and a strategic approach to high-limit claims, you can ensure that the financial fallout doesn’t derail your future. Remember: the insurance company’s first offer is rarely their best offer. Stay organized, stay quiet at the scene, and seek professional legal counsel to navigate the “chain reaction” of the legal system.

FAQ: High-Limit Claims & Pile-Ups

1. What if there are more than five cars involved? The more cars, the more complex the “fault apportionment.” It often requires a multi-party legal conference where all insurance companies negotiate how to split the total damage costs.

2. Can I sue multiple people? Yes. If three different drivers contributed to your injuries (e.g., one hit you from behind, another swerved into you), you can pursue claims against all three policies.

3. Why is my own insurance company calling me? Even if you aren’t at fault, your “PIP” (Personal Injury Protection) or “MedPay” may pay your initial medical bills. Be careful: even your own insurer is looking for ways to limit their liability.

4. How long do these claims take? High-limit claims take longer because the “quantum” of damages (the total value) is harder to calculate. Expect 12–24 months for a full resolution if litigation is required.

5. Is the lead driver ever at fault? Sometimes. if the lead driver “brake checked” someone or had non-functioning brake lights, they can be held partially liable for the ensuing pile-up.