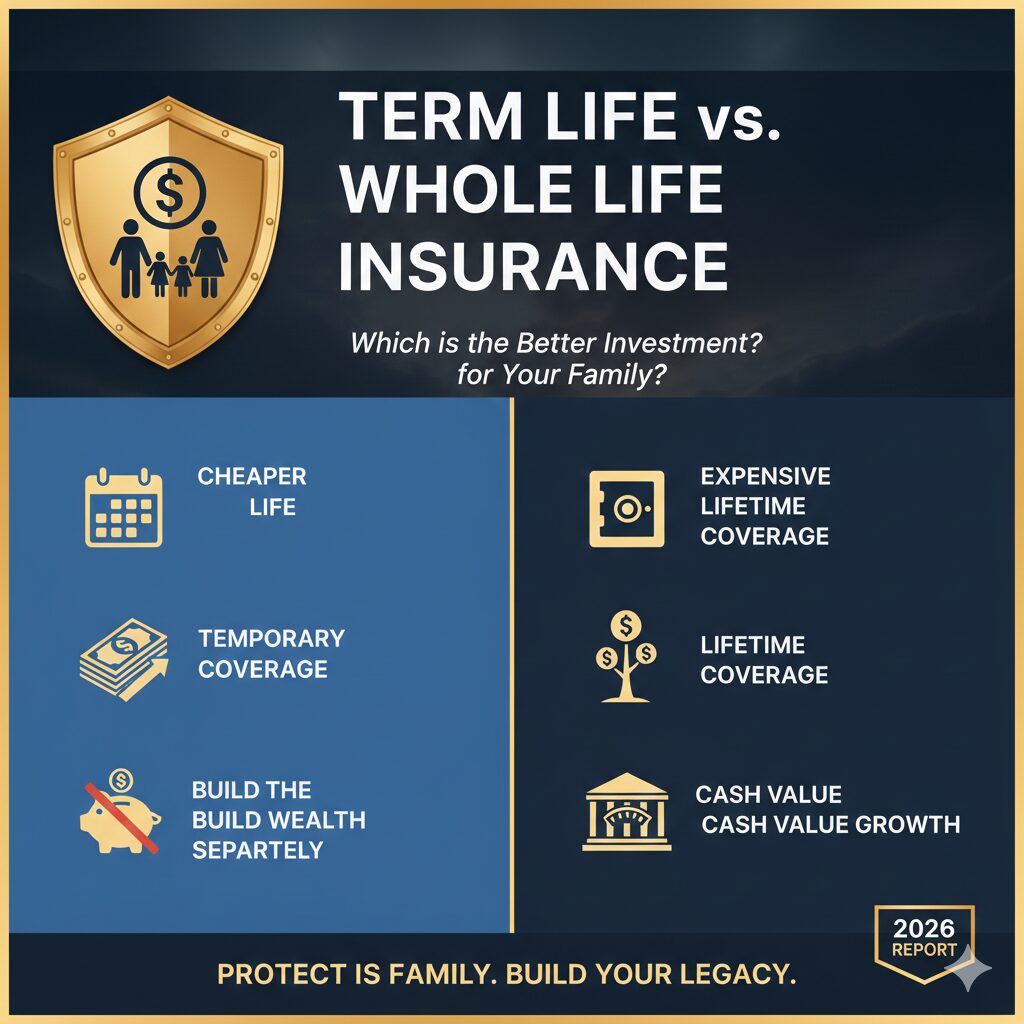

When you’re building a “Greek God” physique, you know that consistency and the right strategy are everything. The same applies to your financial health. In 2026, the insurance market has evolved, offering more “living benefits” than ever before. But the age-old question remains: Should you buy Term Life and “invest the difference,” or go all-in on Whole Life as a permanent asset?

For most families, life insurance is the ultimate safety net. However, viewing it as an investment requires a shift in perspective. Let’s break down the mechanics, the costs, and the long-term ROI of both options.

1. Term Life Insurance: The “Pure Protection” Model

Term life insurance is the most straightforward form of coverage. You pay a premium for a specific period (usually 10, 20, or 30 years). If you pass away during that term, your beneficiaries receive a tax-free lump sum. If you outlive the term, the policy simply expires.

Why It’s Popular for Families:

-

High Coverage, Low Cost: For a healthy 30-year-old, a $1 million term policy can cost as little as $20–$30 a month. This allows you to protect your family’s lifestyle without sacrificing your monthly investment budget for stocks or real estate.

-

Matches Your Liabilities: Most people only need massive coverage while they have a mortgage, young children, or high debt. Term insurance allows you to “insure your needs” until you become self-insured through your own savings.

The “Investment” Strategy: Buy Term and Invest the Difference

The most common advice from financial experts is to buy a cheap term policy and take the money you saved (vs. a whole life premium) and put it into an S&P 500 index fund.

The Logic: Historically, the stock market returns 7–10% annually, whereas the cash value in a whole life policy typically grows at 1–3.5%. Over 30 years, the difference can amount to hundreds of thousands of dollars in extra wealth.

2. Whole Life Insurance: The “Permanent Asset” Model

Whole life is a type of permanent insurance that covers you until the day you die, provided premiums are paid. It includes a cash value component that grows over time.

Why It’s Considered an Investment:

-

Guaranteed Growth: The cash value grows at a fixed rate, unaffected by stock market crashes. In 2026’s volatile economy, this “forced savings” acts as a conservative bond-like asset in your portfolio.

-

Tax-Deferred Growth: You don’t pay taxes on the growth of the cash value while it’s inside the policy.

-

Borrowing Power: You can take out a loan against your own policy’s cash value. Many use this for “Infinite Banking”—borrowing from themselves to buy cars or real estate while their policy continues to earn interest.

-

Dividends: If you buy from a mutual insurance company, you may receive annual dividends (profits shared with policyholders), which can be used to increase your death benefit or pay your premiums.

The Trade-Off: The Cost of Permanence

The biggest hurdle is the price. A whole life policy can be 8 to 10 times more expensive than a term policy for the same death benefit. If you can’t comfortably afford the premiums for the next 20+ years, you risk the policy lapsing, which can result in a total loss of your investment.

3. Side-by-Side Comparison (2026 Data)

| Feature | Term Life Insurance | Whole Life Insurance |

| Duration | 10, 20, or 30 years | Your entire life (up to age 100/121) |

| Premium Cost | Low and affordable | Significantly higher |

| Cash Value | None | Yes (Guaranteed growth) |

| Investment Style | “Buy term, invest the rest” | “All-in-one” protection + savings |

| Best For | Young families with high debt | High-net-worth estate planning |

| Dividends | No | Possible (with mutual companies) |

4. Which is Better for Your Family?

Choose Term Life If:

-

You’re on a Budget: You want the most “bang for your buck” to protect your kids and spouse today.

-

You’re a Disciplined Investor: You will actually take the extra money and put it into a brokerage account or retirement fund.

-

Your Needs are Temporary: You only need coverage until your mortgage is paid off or your kids finish college.

Choose Whole Life If:

-

You Have a Lifelong Dependent: If you have a child with special needs who will require care forever, permanent coverage is a must.

-

You Want a Tax-Shelter: You’ve already maxed out your 401(k) and IRA and want another way to grow money tax-deferred.

-

You Value Predictability: you prefer a guaranteed return over the “rollercoaster” of the stock market.

-

Estate Planning: You want to leave a guaranteed, tax-free inheritance to your heirs to cover estate taxes.

5. The “Bridge” Strategy: Convertible Term

If you’re undecided, look for a Convertible Term Policy. This allows you to start with affordable term coverage now and “convert” it into a whole life policy later without having to take another medical exam. This is a perfect middle ground for young professionals whose income is expected to grow.

Conclusion: Tailoring Your Financial Fitness

Just as there is no single “best” workout for everyone, there is no single best insurance policy. Term Life is the efficient, high-intensity choice for maximum protection during your peak responsibility years. Whole Life is the slow-burn, long-term endurance strategy for wealth preservation and legacy building.

For most growing families, starting with a 20- or 30-year term policy provides the best immediate ROI. It secures your family’s future while freeing up capital to invest in your business, your health, and your retirement.

FAQ: Life Insurance as an Investment

1. Is life insurance a better investment than the stock market?

Generally, no. For pure growth, the stock market usually outperforms the cash value of life insurance. However, life insurance provides a guaranteed death benefit and tax advantages that stocks do not.

2. Can I have both term and whole life?

Yes! Many people use a “laddering” strategy: a large term policy for their working years and a smaller whole life policy for final expenses and legacy planning.

3. What happens to the cash value when I die?

In most standard whole life policies, the insurance company keeps the cash value and pays your beneficiaries the death benefit. However, some “enhanced” policies pay both, though they come with higher premiums.

4. Is the death benefit taxable?

In almost all cases, the death benefit paid to your beneficiaries is 100% federal income tax-free.