When it comes to high-yield savings, CIT Bank is a powerhouse. But for “super savers” and those building significant emergency funds, one question always looms larger than interest rates: Is my money actually safe?

The short answer is yes. CIT Bank is a division of First-Citizens Bank & Trust Company, a member of the Federal Deposit Insurance Corporation (FDIC). However, understanding the amount and the fine print of your insurance coverage is the difference between a secure portfolio and a risky one.

In this guide, we’ll break down exactly how much CIT Bank FDIC insurance you have, how the First Citizens merger affects your limits, and advanced strategies to protect over $250,000 at a single institution.

What is the CIT Bank FDIC Insured Amount?

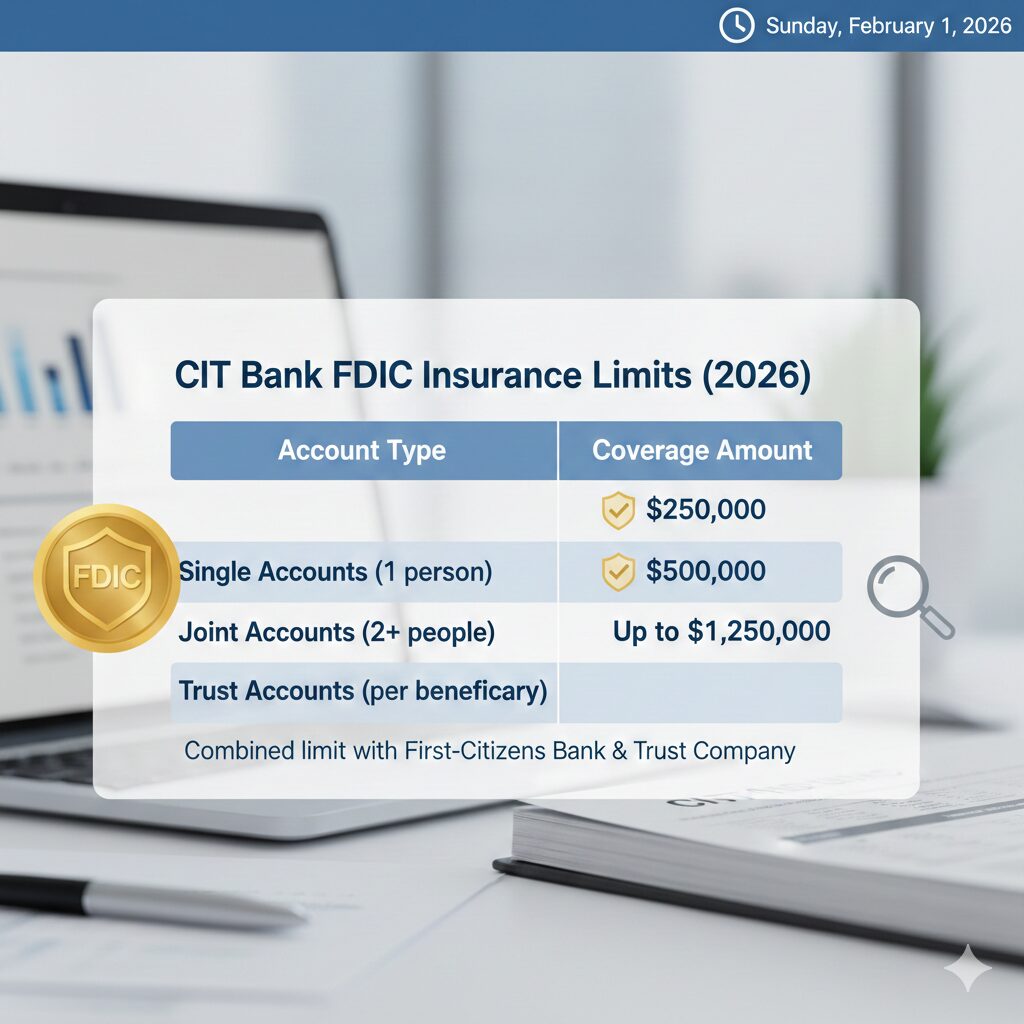

The standard FDIC insurance amount at CIT Bank is $250,000 per depositor, per ownership category.

This isn’t just a CIT Bank rule; it’s a federal mandate. If CIT Bank or its parent company were to fail, the FDIC steps in to ensure you get your money back, dollar-for-dollar, up to that limit—including your original principal and all accrued interest.

The “First Citizens” Factor: A Critical Warning

It is vital to know that CIT Bank is a division of First-Citizens Bank & Trust Company. Because they are legally the same entity, the FDIC treats them as one bank. If you have $250,000 in a CIT Bank Savings Connect account and another $100,000 in a checking account at a local First Citizens branch, $100,000 of your money is uninsured. > Pro Tip: Always calculate your total balance across both brands to ensure you haven’t accidentally crossed the $250k threshold.

How FDIC Insurance Limits Work by Account Category

Most people think $250,000 is the hard “ceiling,” but that’s not entirely true. Your total coverage depends on how your accounts are “titled” or owned. By using different ownership categories, you can significantly increase your CIT Bank FDIC insured amount.

1. Single Accounts ($250,000)

These are accounts owned by one person with no beneficiaries. All single accounts you own at CIT/First Citizens are added together.

-

Example: If you have a Savings Connect and a No-Penalty CD in your name only, their combined balance is insured up to $250k.

2. Joint Accounts ($500,000+)

Joint accounts are owned by two or more people. Each co-owner is insured for up to $250,000 for their share.

-

The Math: A married couple with a joint account is covered for $500,000.

-

Strategy: If you and your spouse each have individual accounts ($250k each) and one joint account ($500k), your total coverage at CIT Bank jumps to $1,000,000.

3. Trust Accounts ($250,000 per Beneficiary)

Revocable trust accounts (including “Payable on Death” or POD accounts) offer some of the highest protection. The FDIC generally insures these for $250,000 per unique beneficiary, up to five beneficiaries.

-

Example: A trust account with one owner and three children as beneficiaries could be insured for up to $750,000.

4. Retirement Accounts ($250,000)

Qualifying retirement accounts, like Traditional or Roth IRAs held in bank deposits, are insured separately from your personal savings.

Which CIT Bank Products Are Covered?

Not everything you “buy” at a bank is insured. Fortunately, CIT Bank’s primary products are all covered:

-

Savings Connect & Savings Builder: High-yield savings.

-

Money Market Accounts: Flexible savings with check-writing.

-

Certificates of Deposit (CDs): Term, No-Penalty, and Jumbo CDs.

-

eChecking: Online checking accounts.

What is NOT covered? If you use a brokerage sweep program or invest in stocks, bonds, or mutual funds through an affiliate, those are not FDIC-insured. FDIC only covers “deposit” products.

3 Strategies to Maximize Your Coverage at CIT Bank

If your net worth is growing, you don’t necessarily have to move to a different bank the moment you hit $250,001. Here is how to stay protected:

Strategy A: The “Joint + Individual” Shuffle

As mentioned, a couple can effectively quadruple their coverage at CIT Bank by maintaining two individual accounts and one joint account. This keeps $1 million under the federal safety net without ever leaving the CIT platform.

Strategy B: Utilize POD Beneficiaries

Adding beneficiaries to your accounts (making them “Payable on Death”) can instantly change your ownership category from “Single” to “Trust,” potentially increasing your limit based on the number of people named.

Strategy C: The “Multi-Bank” Approach

If you are an individual with over $1 million in cash, no amount of “titling” at one bank will fully protect you. In this case, it is best to use CIT Bank for your first $250,000 to capture their high rates and move the excess to another FDIC-insured institution.

Conclusion

Knowing your CIT Bank FDIC insured amount is the foundation of a smart financial plan. While the standard $250,000 limit is the baseline, savvy savers can leverage joint accounts and trusts to protect much larger sums.

The most important takeaway for 2026? Remember that CIT Bank and First Citizens Bank share the same insurance umbrella. Keep your combined balances in check, and you can enjoy those high APYs with total peace of mind.

FAQ: Frequently Asked Questions

1. Is CIT Bank safe?

Yes. CIT Bank is a division of First-Citizens Bank & Trust Company, a top-20 U.S. bank. It is FDIC-insured, meaning the U.S. government guarantees your deposits up to the legal limits.

2. Is CIT Bank separate from First Citizens for FDIC insurance?

No. Because CIT is a division of First Citizens, your deposits at both are combined when calculating your $250,000 insurance limit.

3. Does FDIC insurance cover interest earned?

Yes. The $250,000 limit applies to the sum of your principal plus the interest you have earned.

4. How can I check my specific coverage?

You can use the FDIC’s official tool, EDIE (Electronic Deposit Insurance Estimator), to input your specific account types and see exactly how much is protected.

5. What happens if I have $300,000 in a single account?

In the event of a bank failure, the first $250,000 is guaranteed to be returned to you. The remaining $50,000 is technically uninsured, and you would become a creditor of the bank’s estate to try and recover those funds.